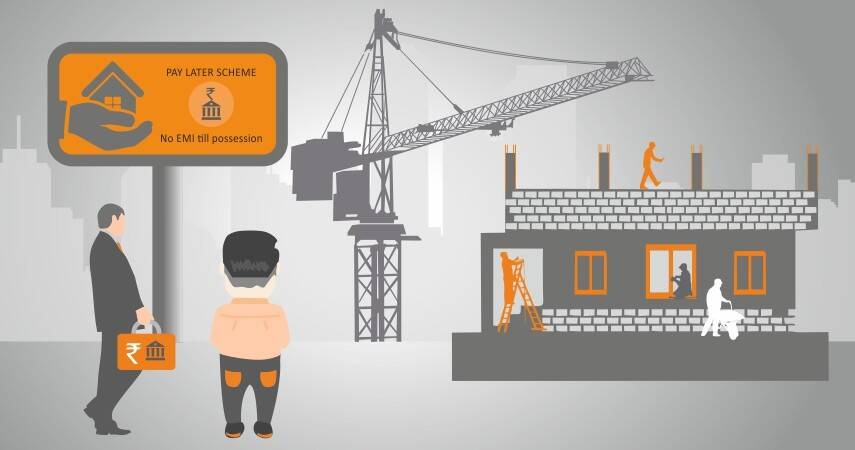

If we look at this scheme, then a person needs to pay an amount of 15 percent while booking, then a good amount of money would be paid by the financial institution from where the buyer takes the loan from. The buyer will be required to sign a tri-partite agreement with the developers and the lender as well. The buyers get a sufficient amount of time to collect and accumulate the funds for the amount he/she needs to pay at possession. The EMI will be starting on after the buyer gets the possession. This scheme till here is beneficial and good. But the scheme of No EMI can be a little risky as NO EMI here, does not imply that there will be no EMI outgo, but what it means is that the EMI would be paid by the developers on behalf of a home buyer. Hence if the developer fails to pay the EMI or if there is any default on the developer’s part then the buyer would be held liable and the buyer’s credit score will affect badly.

Also if there a delay in the project, then the buyer will have to pay the EMI before he or she gets the possession, which implies that along with the rent they pay, they also have to pay the EMI that stretches their finances. So it is advisable to go for a scheme which says ‘No EMI till possession’, as then the risk is completely transferred to the concerned builder.

Today, we come across a lot of cases which deals with the delay in projects and loan defaults by the developers. Hence it is highly important to be careful with such schemes they give. Buyer should thoroughly read the agreement’s fine print and also look in for the reputed and credible builders.

No matter how attractive the scheme is, the buyer needs to witty and mindful regarding the risk that it might involve.