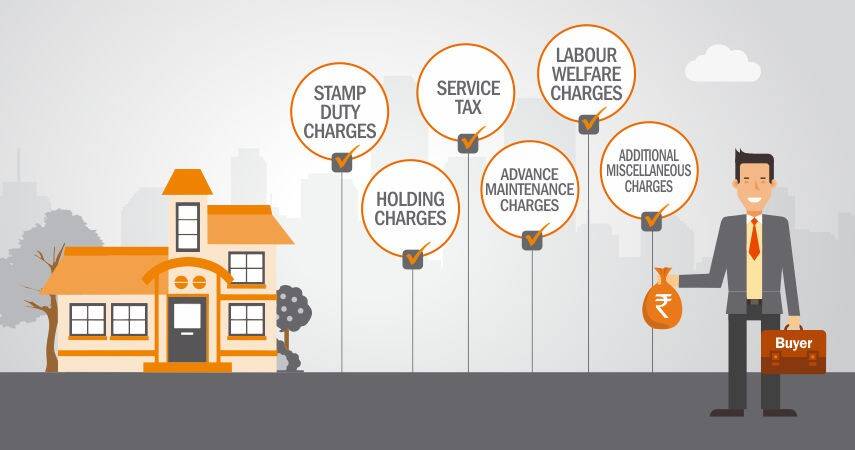

let us further understand such costs in brief:

Stamp duty charges

Stamp duty is payable to the state government. Stamp duty varies from different state to state and property to property. A sale agreement not stamped well does not allow it to stand in the court of law. Payment of this duty recognises the legal status of the transaction of property. It’s necessary for the person to pay the stamp duty to get the possession of the property.

Service tax

Service tax is levied by the central government and is fix and universal in the whole country. It is charged only on under construction projects and not on ready-to-move-in apartments. The service tax as of now is 15 percent levied on the 25 percent of the property value which comes to 3.75 percent on the total value of the property. The service tax directly goes in the pocket of central government it’s also charged on other factors.

Labour welfare charges

The developer usually charges 1 percent of construction cost which further goes for the welfare of the labourers who worked to build the premises. Example if the worth of property is Rs 1.5 crore than 1 percent of such amount which is Rs 15000 goes to the welfare fund of the labourer. Such money of labour welfare fund is used towards the education of labourers children, medical needs of labourer etc.

Advance maintenance charges

The developer may ask for maintenance of the premises even before handing over the possession and such maintenance of group society is generally higher due to additional factors like the security of the society, maintenance of other amenities like garden, club house etc.

Holding charges

Once the buyer receives the demand letter from the developer for the possession of the property than after receiving such letter it’s the responsibility of the buyer to pay the remaining due amount to the developer. The period to pay the due amount is usually 30 to 60 days once the last date is gone. The developer may find you withholding charges until the time the charges are not paid and possession is not given off. After all, these warnings and extra time granted to the end developer may even cancel the allocation or charge interest on delayed payment.

Additional miscellaneous charges

there may be more such additional miscellaneous charges levied upon like firefighting equipment charges, gas pipeline charges, water pipeline charges, power back up charges, an increase in escalation charges etc. the developer may increase such charges saying that there has been an increase in the market rate of raw material and labour.

Hence, a person needs to properly verify and calculate such additional charges so that there is no overall mistake made while calculating it. Therefore it’s essential that buyer pays all the remaining payment and such extra charges so that buyer can get quick possession and smooth transfer of property in his name. This also makes it easy for the buyer to stand in the court of law in the case of any dispute.